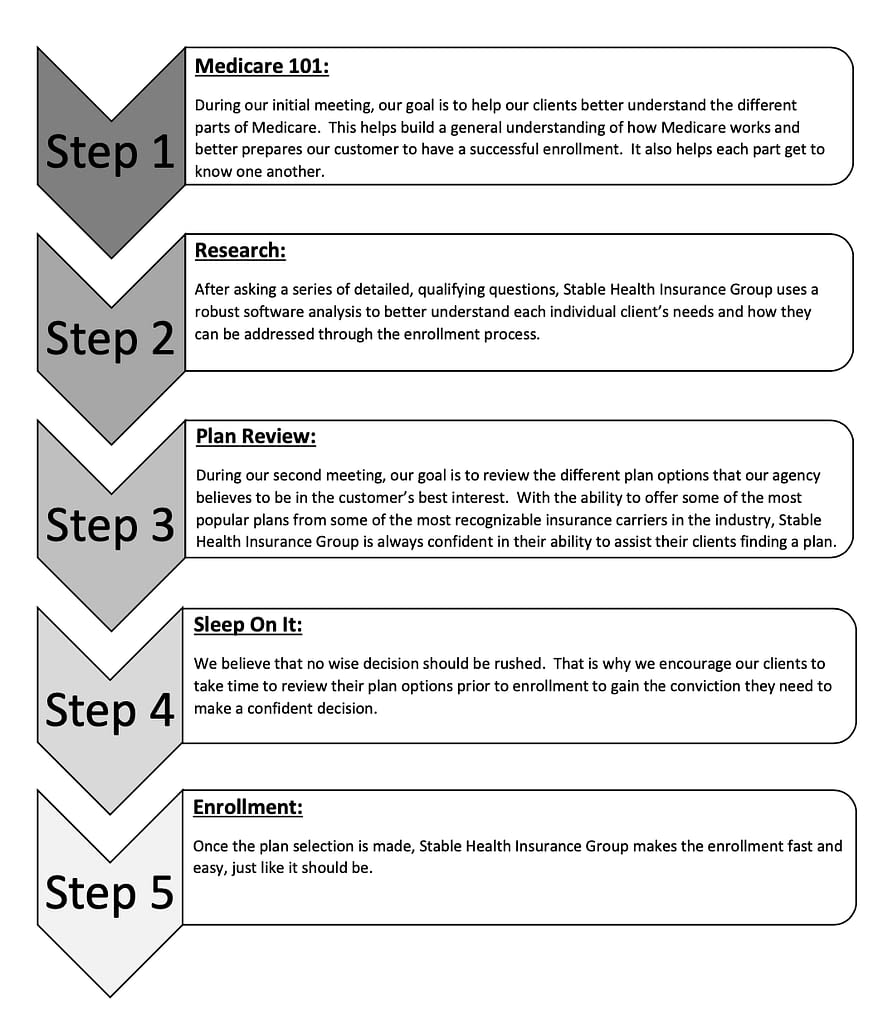

At Stable Health Insurance Group, our mission is simple: to make Medicare enrollment an easy transition for our clients. In today’s marketplace, enrolling into Medicare can be everything but easy and we take great pride in reversing that script. The foundational principle that guides our work is providing educational, unbiased, and trustworthy advice so that our clients can have conviction behind their enrollment selection. We execute this through our simple, linear, 5-step process, all at no cost to our clients:

An Independent Advantage

We are Independent Agents in , Ohio, free to choose the best carrier for your insurance needs. We do not work for an insurance company; we work for you. We work on your side when you have a loss and follow through to see that you get fair, prompt payment and service. Stable Health Insurance Group represents a carefully selected group of financially strong, reputable insurance companies. Therefore, we are able to offer you the best coverage at the most competitive price.

What is an Independent Insurance Agent?

When you decide to buy a car, you wouldn’t purchase the first one you see. What if one day the automobile industry decided to make only one type of car, one make and one model. You wouldn’t have a choice!

The same situation holds true for insurance. You need insurance to drive a car, to purchase a house, to protect your family’s financial future and to run a small business. But if there was only one insurance company that offered only one type of insurance, you wouldn’t have a choice. The only solution would be going to that one company.

With an independent insurance agent, you have choices. Independent agents are not tied to any one insurance company. One of the advantages of using an independent agent is that he or she works to satisfy your needs. You are using an expert for an important financial decision.

An independent agent has several companies that he or she can approach to get you the best coverage at the best price. And your independent agent will know the companies with the most efficient claims departments to recover your losses as quickly as possible.

When you buy insurance, you want an advocate who will properly assess the risks you face and give you an objective analysis of the marketplace, because it’s up to you to make the final choice.